Business Insurance in and around South Bend

One of South Bend’s top choices for small business insurance.

No funny business here

Insure The Business You've Built.

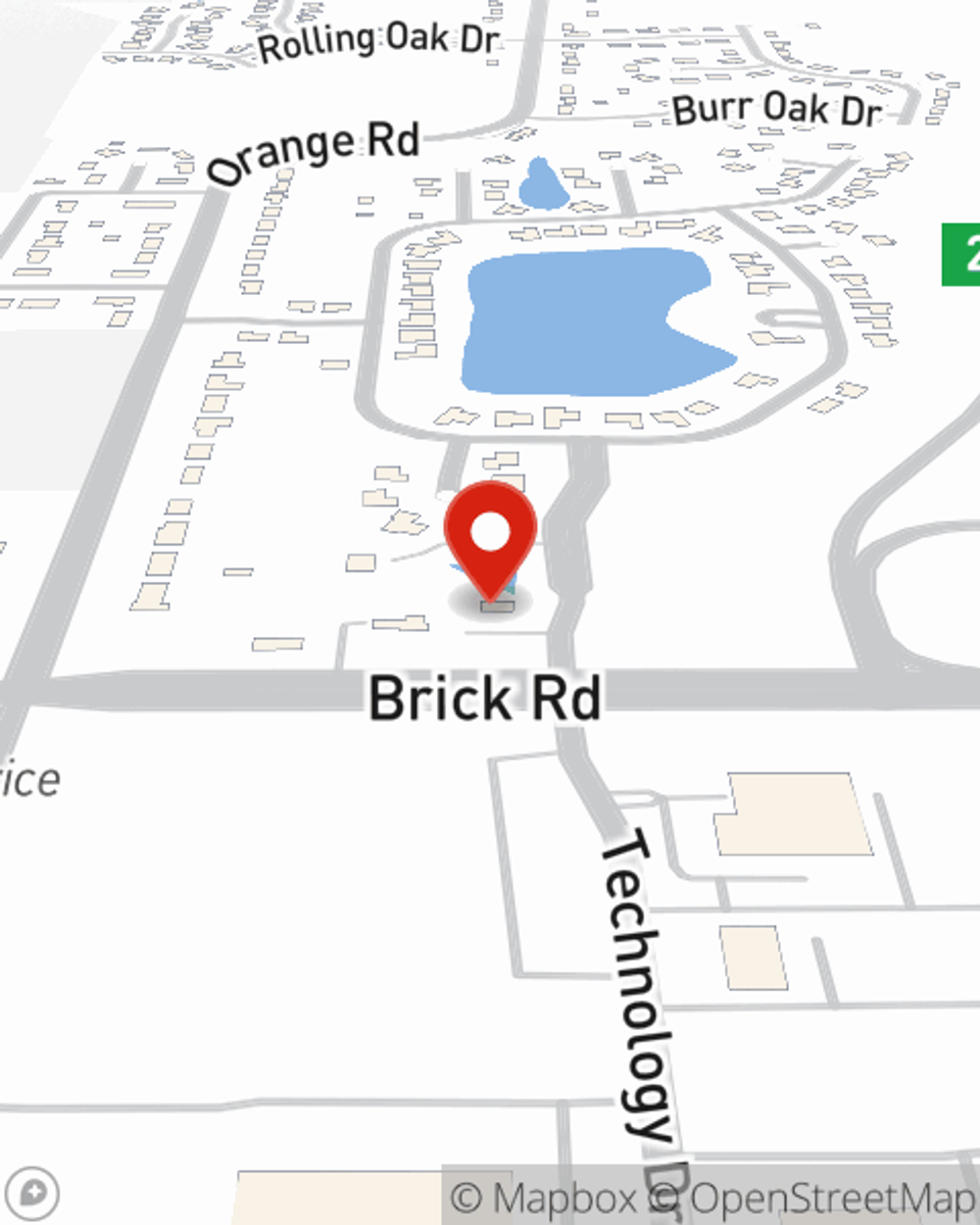

It's a lot of responsibility to start and run a business, but you don't have to figure it out all on your own. As someone who also runs a business, State Farm agent Tim Grauel recognizes the work that it takes and would love to help lift some of the burden. This is insurance you'll definitely want to consider.

One of South Bend’s top choices for small business insurance.

No funny business here

Insurance Designed For Small Business

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is closed down. It not only protects your compensation, but also helps with regular payroll overhead. You can also include liability, which is critical coverage protecting your company in the event of a claim or judgment against you by a consumer.

Reach out to State Farm agent Tim Grauel today to find out how the trusted name for small business insurance can ease your worries about the future here in South Bend, IN.

Simple Insights®

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

Tim Grauel

State Farm® Insurance AgentSimple Insights®

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.